What is a Payment Gateway?

And why should your E-Commerce business have one?

There are many considerable factors when you are setting up an E-Commerce business. One of these factors is how to accept payments and provide an easy payment process for customers. As such, your business needs a payment gateway to streamline the checkout process and improve the security of customers’ payment details. Here is everything you need to know about payment gateways in 2021.

What is Payment Gateway

A payment gateway is an E-Commerce service that allows to process payments, namely debit and credit cards, by transferring key information between a website and a bank. When a customer enters their card details at the checkout process, the gateway is the first element that receives all information. Communicating directly with issuing banks helps to authenticate the payment details. Thus, payments will be automatically accepted/rejected based on factors, including if a customer has enough funds in the bank account and if the card details have been entered correctly.

In other words, the payment gateway simply facilitates the transfer of money between a customer and a seller. Additionally, the payment gateway helps to prevent your business from fraudulent payments, provides highly secured data protection for both parties as all personal data is encrypted.

How does it work?

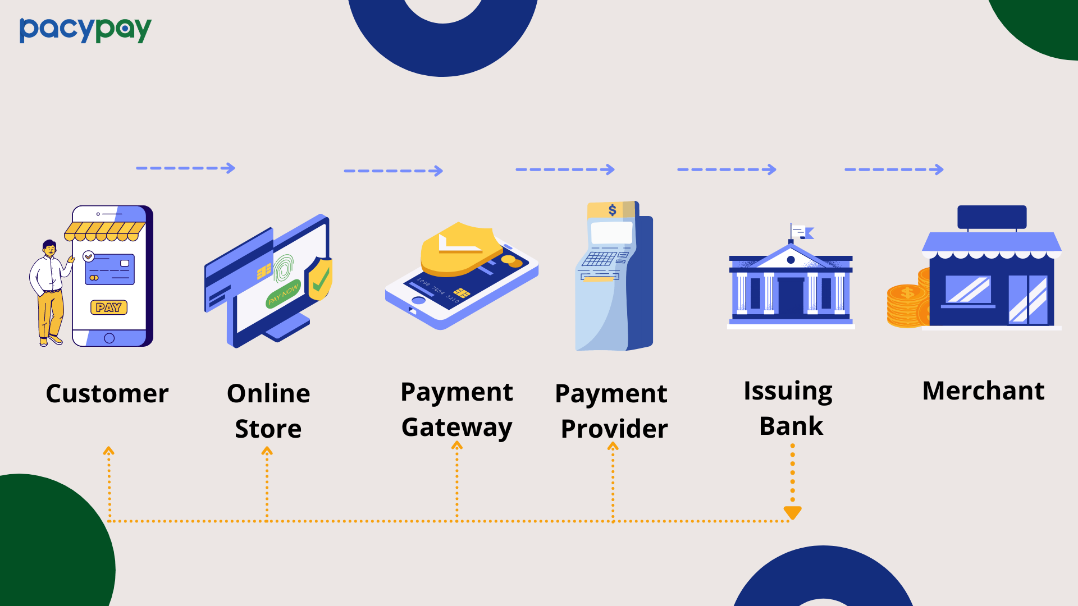

An E-Commerce payment gateway involves a series of steps to complete payment:

A customer places an order and enters their card details into the payment page.

The payment gateway receives the transaction details, including amount, currency, cardholder name, address and other transactional information. Following that, the gateway identifies which card provider (E.g Visa, MasterCard, American Express) issues the customer’s card and redirects the transactional data to the right payment network for confirmation.

The transactional process has become much easier with payment gateways, as they are always up to date with information about cards and banks and have a direct connection with issuing banks. The communication with the bank only starts after all transactional details are checked by the payment gateway; it includes, checking the card has not expired, the card details are entered correctly and whatever a merchant accepts the chosen payment method.

Once the transaction is passed to the issuing bank, it starts the authentication process and ascertains that the customer has enough funds in their account to complete a purchase. Based on it the transaction is approved or declined by the bank and responds back to the payment gateway. The customer and the merchant will be informed whether a transaction is successful.

If the transaction is accepted, the merchant will receive funds to his merchant account where it will stay for the agreed settlement period, before being sent to a business bank account.

Choosing the right payment gateway

Nowadays, the payment market is full of various options of payment gateways and you might wonder how to choose the right for your business.

First of all, make sure that you know the cost of the service on a market. Payment gateways offer different tiers of fees and charges based on factors such as transaction volume, which typically includes a setup charge, transactional fees and a monthly fee for the service. The cost also might vary depending on your business model, such as the high-risk business industries will usually have to pay more due to the increased risk of fraudulent and chargeback activities.

Another significant aspect to consider is whatever you are planning to sell to international customers. If you want to expand your business globally, you will have to accept various currencies. If it is a business goal, make sure you select a provider which handles both international and domestic payments. It will significantly reduce the price if you chose to have one payment gateway to handle all transactions.

Security is an absolutely essential factor when taking payment transactions for both parties. The best payment gateways comply with the PCI DSS (Payment Card Industry Data Security Standard), which requires all card data to be stored and processed in a secure environment. It ensures that customer data and card information is prevented from fraud activities and chances to be stolen. In other words, you should choose a payment gateway with a high level of encryption to provide customers safe environment for payment transactions.

Benefits of Payment Gateway:

· Merchant Account. With setting up the payment gateway for your website, you will get a merchant account with the same provider, which allows receiving the funds after accepted transactions. By using a merchant account, you will be able to manage your cash flow and easily stay organized. Moreover, in the merchant portal, you can find sufficient insights and analysis of your transactions with currencies, payment methods and other information; which will help to keep an eye on the profit and grow sales.

· Fraud Management. One of the strongest benefits of the payment gateway is fraud prevention, which makes online payment transactions more secure and credible. You can limit fraudsters by blocking transactions from suspicious IP and email hotlists. The available check of Card Security Code and Address allow payment gateway to verify the customer and prevent the hassle of fake checks. Implementing payment gateway to E-Commerce businesses will highly protect your business and your customers, which also consequently raises business credibility and reliability.

· Customer Support. Another advantage is customer support that solves any arising payment issues.

PacyPay helps global merchants by delivering secure, reliable payment gateways for businesses connecting them with global consumers. We are recognized for our competitive, flexible approach for both partner payment support and innovation.

Get in touch with us today to learn more about payment gateways for your business.